Over the past few months, we have had more and more requests from customers specialising in debt collection and we have done some extended development to assist with that.

Typically, a debt collector may have a several contact numbers, such as a home phone and a cell phone. In a first instance, the debt collection agency using PowerCall AI will be able to import debtors with more than one phone number, as well as assign list of fields that will be helpful for the agents or the IVR when contacting the debtor.

PowerCall AI’s debt collection software is highly flexible and versatile with detailed reporting in near real-time and downloadable reports for later analysis. For a live demo or for more information, please contact us.

Looking for Debt recovery solutions?

PowerCall AI allows you now to try each number you have on record until you get a response from the debtor, if the first number fails it will try the second, and then the third, up to a total of 6 contact phone numbers.

The system can make follow-on calls to the hunting numbers if:

- No one answers the call, either because it is engaged or unobtainable.

- An answering machine answers, and you don’t want to leave a message after the beep.

- The debtor hangs up without listening to the entire message and responding to it.

Once a debtor has responded to the message, then no further attempts to reach the debtor are made.

Using PowerCall AI for automated debt collection can now be considered a valuable and cost-saving tool for contacting debtors and achieving good results.

We have created a video demonstrating the debt collection call script, uploading contacts and configuring the campaign.

Outbound | Inbound | Fully Blended

Powercall AI’s call centre technology provides collection agencies with the capability to run high volume inbound, outbound and fully blended campaigns, and in addition, prioritise inbound calls and web enquiries. Likewise, agents can operate across multiple campaigns (inbound and/or outbound), with specific scripts, FAQ, Skills-Based Routing and Reporting. Moreover, Skills-Based Routing directs debtors to the most appropriate agents, based on individual and/or group skill levels of particular products, and/or ability to respond via different channels ie; Voice, SMS, Web, Email etc.

Omni Channel Communications

Collection agencies gain capability to communicate with debtors, with both relevance and immediacy via the OmniChannel platform, communicating across multiple channels ie; Voice, SMS, Email, Voice Broadcasting, Web-Chat, Click-to-Call, IVR, Social Media, Websites and Client Portals. Moreover, collection agencies gain end-to-end transparency of the collections cycle, and therefore able to comply with contact rates of the ‘collections code’, and indeed improve collections rates in the process. Likewise, the endless capabilities of the OmniChannel platform offers a more personalised approach to collecting debt across the different touchpoints of the collections cycle.

Purchased Debt

The predictive dialler function continues to be the primary function to handle purchased debt; as it efficiently dials through ‘ledgers’ in compliance with the debt collection code. The fully integrated SMS component of the system is also used to improve efficiencies in retrieving debt. In a fully-blended environment, inbound calls can also be prioritised over outbound calls to attend call-backs from debtors wanting to settle debts. Automated payment gateways are also a cost efficient and effective means of recovering debt without need for human intervention.

Contingent Debt

Powercall AI utilises ideal call centre technology to effectively manage the complexities of contingent debt. The OmniChannel platform not only optimises contact centre performance, it provides a means of executing business strategies and developing highly efficient business practices in compliance with the debt collection code. In other words, you can map your business processes with Powercall AI technology in order to communicate with debtors in an integrated manner across multiple channels; and most importantly, provide meaningful information to management at all levels; whilst promoting best practice principles and continuous improvement.

Gain competitive advantage by engaging with debtors in the most relevant, timely and efficient means. The OmniChannel platform is an advanced call centre communications platform, that not only facilitates interactions with debtors across multiple channels – it does so in an intuitive and integrated manner. For instance, debtors can interact with agencies across; Voice, SMS, Email, Voice Broadcasting, Web-Chat, Click to Call, IVR, Payment Gateways, Fax, and Debtor Portals.

Moreover, the Powercall AI OmniChannel has the capability to respond with relevance and immediacy – and in a more personalised fashion across the different debtor touchpoints. Importantly, customer mobility on various smart devices can also be taken into consideration in the communications strategy.

Skip Tracing

Enhance both skip tracing practices and compliance with Powercall AI. Calls can be manually made via an agent desktop or IP Handset, whilst scripts and FAQ provide a consistent dialog. Importantly, there is a full audit trail of actions to track activities and outcomes, including PCI DSS compliant call recording. Credit card payments can also be made directly by agents via a desktop payment gateway.

Compliance

Acknowledging that compliance with the ACCC & ASIC guidelines is business critical for collection agencies and for that matter, any organisation carrying out collections activities, the feature-set, and indeed flexibility of Powercall AI call centre systems enables organisations to meet the immediate and inevitable changing requirements of the debt collection code.

Quality Assurance

The QA screen facilitates quality control of agent interaction with debtors; enabling Quality Control teams to screen random samples of calls to assess and score agent and group performance. Likewise, the ‘Post Call Survey’ function provides valuable feedback to the organisation from debtors.

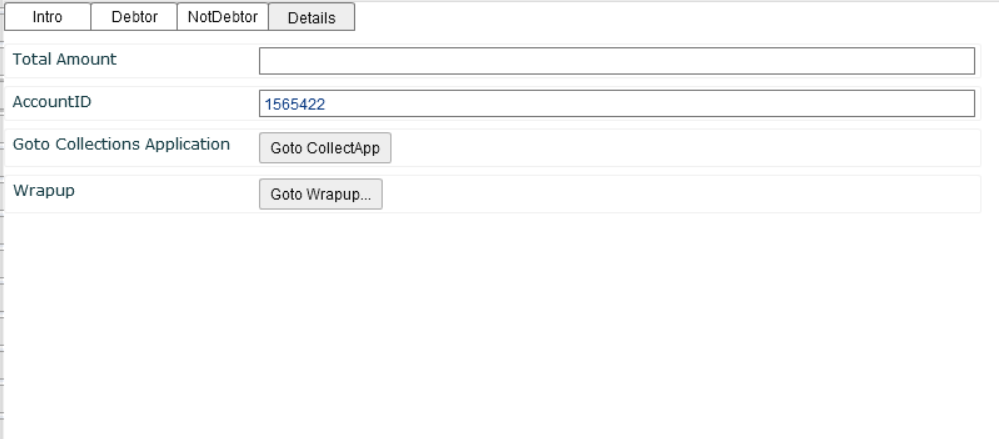

Collections Software Integration

Powercall AI call centre systems have been integrated with collections software such as; Wincollect, Debtcol, Collect!, Mercantile; and various other software that has developed in-house by our clients.

Payment Facilitation

Powercall AI call centre systems integrate with both merchant bank and internal payment gateways – as required. Likewise, Powercall AI call centre systems are fully integrated with payment gateways such as Eway, Ezidebit and PayPal. Furthermore, verbal agreements and payment arrangements made with agents can be recorded, with credit card payments made in accordance with PCI-DSS call recording and data requirements.

Websites | Client Portals

Optimise the performance of your website or client portal with Powercall AI’s functions such as; Click to Call, Web Chat and Online Lead Priority. These enhanced communication channels are effectively managed via the OmniChannel platform, with automated processes or agents in your call centre able to deal with online enquiries as a priority.

Data Analytics

Powercall AI’s Predictive Data Analytics enables collections agencies to determine both the Right Time to Call debtors, and by which communication channel via the Powercall Ai’s Omnichannel platform. Moreover data analytics promotes best practice and advanced list management strategies to optimise campaign performance.

Powercall AI’s Predictive Data Analytics empowers collections agencies to optimise business performance via; 1) Preferred Time to Call & Schedule Optimisation 2) Advanced Contact Analytics 3) Automated Decisioning and 4) Dynamic Campaign Management.

National & Global Operations

Call centre and PBX technology as onsite systems or cloud services can be configured as a single site or alternatively across multiple sites in Australia or around the globe; as either centralised or localised models. Likewise, agents can operate from home with full transparency of activity visible via the Supervisor screen. Outsourced Call Centres can also operate on the same Powercall AI’s platform as your own operation, and hence activity is readily available via the Supervisor screen. The ‘Presence’ function also provides absolute transparency of the status of staff across sites, and hence their availability.

Business Continuity

Acknowledging the business critical nature of the collections sector, Business Continuity and Disaster Recovery elements are incorporated in both Powercall AI Cloud services and on-premise system infrastructure. For instance, the Powercall AI cloud service is managed across multiple data centres in Australia, in addition to strategic global locations for our overseas clients. Data centres are N+1 facilities with UPS & Diesel Generator back-up, multiple telephony back-ups, Dual Power, Hot Swap Raid, Dual Networks, Multi Network Servers, Network Redundancy and Multi Site Access.

Operational Transparency – Quality Reporting

In both graphical and statistical displays, Supervisors and Management alike will have absolute transparency of Contact Centre operations via the Supervisor screen, Call Centre APP, and Wallboards;

- Real-Time & Historical Performance Management reports

- Real-Time & Historical Contact Centre Performance reports

- Call Recording & Live Call Monitoring

- Data Analytics

- Remote VPN & Smart Device access to Management Reports, Call Centre Reports and Call Recording & Live Call Monitoring

PCXCom systems have four access levels of reporting;

- Senior Management | KPI Performance Screen &

- Contact Centre | Performance Management WallBoard Display

- Supervisor & Team Leader | Supervisor Screen – Performance Management, KPI & System Performance plus the PCXCom Smart Device APP

- Agent | Self Performance

Key Functionality for Quality Collection Operations

What appeals most about PCXCom systems is their reliability and agility to manage multiple campaigns in compliance with regulatory requirements. Key functions include;

- Predictive Dialler

- Inbound Call Management IVR & ACD

- Fully Blended Environments

- Call Recording & Monitoring

- Workforce Management (WFM)

- Payment Gateways

- Speech Recognition

- Collections Software Integration

- Right Time to Call

- OmniChannel Communications

- Integrated Messaging

- PCI DSS Compliance

- Multi-site capability